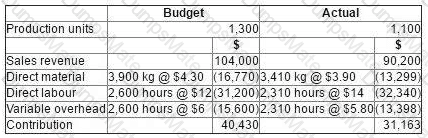

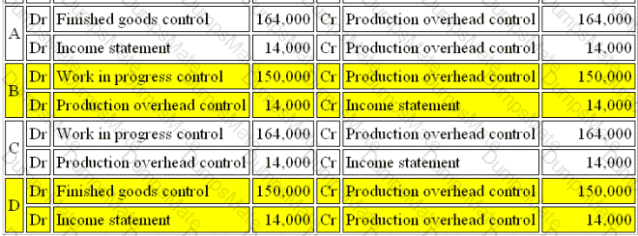

Refer to the exhibit.

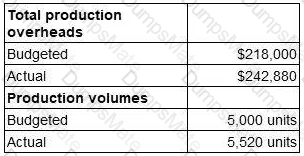

WS operates an integrated accounting system. Transactions relating to production overheads for the month of May were as follows:

Indirect Material costs were $15,000

Indirect Labour Costs were $45,000

Production overheads of $58,000 were incurred during the period.

Depreciation of factory machinery amounted to $32,000.

Overheads costs absorbed by production using a standard absorption rate was $164,000 for the period.

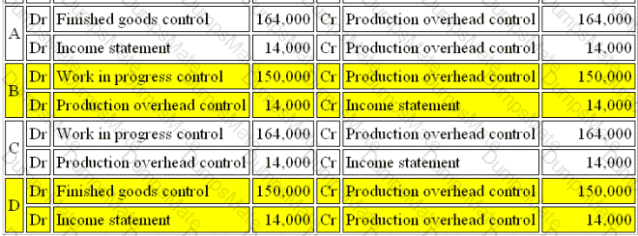

What are the correct entries to record the absorption of production overheads for the period?

The correct set of entries to record the absorption of production overheads for the period is: