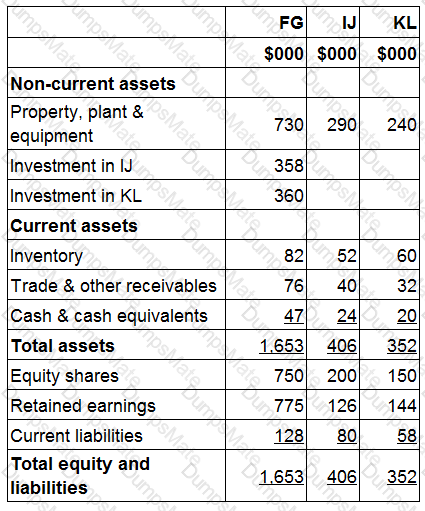

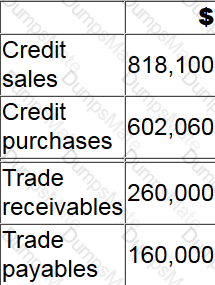

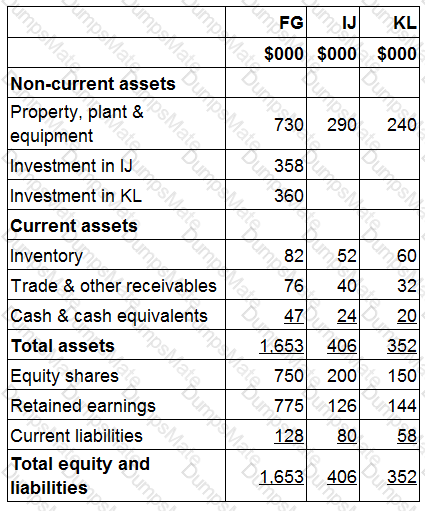

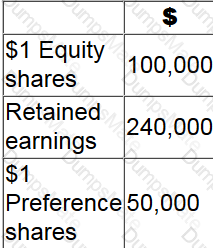

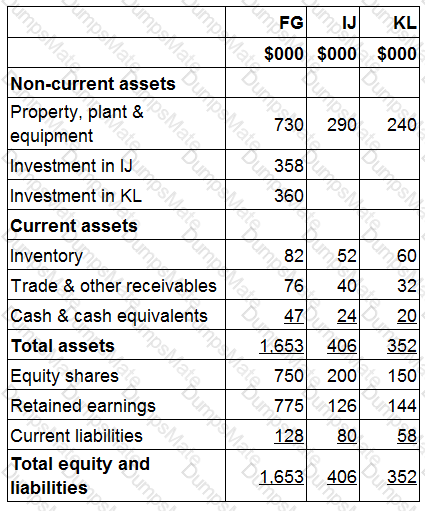

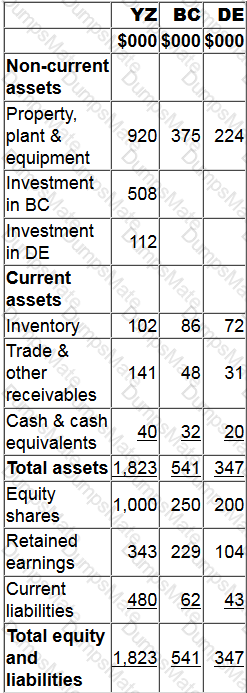

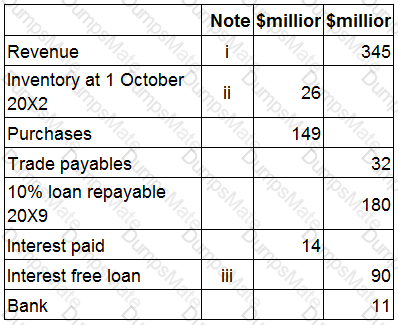

Statements of financial position for FG, IJ and KL at 31 December 20X5 include the following balances:

FG acquired 90% of IJ's equity shares for $358,000 on 1 July 20X5 when IJ's retained earnings were $98,000.

FG acquired 100% of KL's equity shares for $360,000 on 1 January 20X5 when KL's retained earnings were $155,000.

FG used the proportion of net assets method to value non-controlling interests at acquisition.

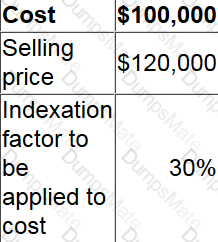

KL sold a piece of land to FG for $130,000 on 1 September 20X5. At the date of transfer the land had a carrying value of $50,000.

The management of FG expect KL to make profits in the future and no impairment ot its goodwill was proposed at 31 December 20X5.

Calculate the total goodwill to be included in FG's consolidated statement of financial position as at 31 December 20X5.

Give your answer to the nearest whole $.

c

c