IMA CMA-Strategic-Financial-Management Exam Dumps FAQs

1. What is the IMA CMA Strategic Financial Management Exam?

The CMA Strategic Financial Management exam is Part 2 of the Certified Management Accountant (CMA) certification offered by the Institute of Management Accountants (IMA). It assesses a candidate’s expertise in financial decision-making, risk management, investment analysis, and professional ethics.

2. Who should take the CMA-Strategic-Financial-Management Exam?

The IMA CMA-Strategic-Financial-Management exam is designed for finance professionals, accountants, and strategic planners who aim to validate their skills in financial strategy, corporate finance, and ethical decision-making. It’s ideal for those pursuing leadership roles in financial management.

3. What are the main topics covered in the CMA Strategic Financial Management Exam?

The exam covers the following six content areas:

-

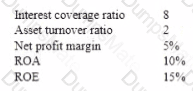

Financial Statement Analysis

-

Corporate Finance

-

Decision Analysis

-

Risk Management

-

Investment Decisions

-

Professional Ethics

4. How many questions are on the CMA Strategic Financial Management Exam?

The exam includes 100 multiple-choice questions and 2 essay scenarios. Candidates have 4 hours to complete the exam—3 hours for MCQs and 1 hour for essays.

5. What is the passing score for the CMA Strategic Financial Management Exam?

The passing score is 360 out of 500. Candidates must demonstrate proficiency across all topic areas to achieve certification.

6. What is the difference between the IMA CMA-Strategic-Financial-Management and CMA-Financial-Planning-Performance-and-Analytics?

- The CMA-Financial-Planning-Performance-and-Analytics exam is Part 1 of the CMA program. It focuses on areas such as cost management, budgeting, internal controls, and financial reporting.

- The CMA-Strategic-Financial-Management exam is Part 2 of the CMA program. It emphasizes advanced topics like financial statement analysis, corporate finance, decision analysis, risk management, investment decisions, and professional ethics.

7. What makes DumpsMate different from other CMA exam prep providers?

DumpsMate stands out by offering CMA-Strategic-Financial-Management real questions, expert explanations, and a testing engine that simulates the actual exam environment. Our success guarantee and instant access make us a trusted choice for professionals.

8. How often are DumpsMates CMA-Strategic-Financial-Management practice questions updated?

DumpsMate updates its CMA-Strategic-Financial-Management practice questions regularly based on feedback from recent test-takers and changes in the official IMA syllabus. This keeps your preparation aligned with current standards.