Section C (4 Mark)

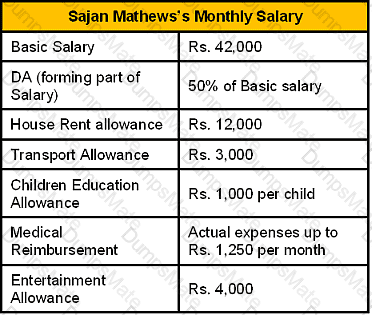

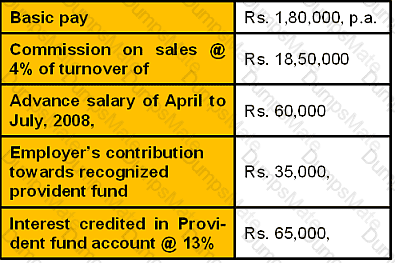

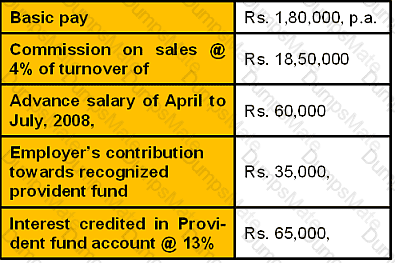

Mr. Sushobhan Adhikari, 56 years old, employee of Mega India Ltd, receives the following salary and perquisites from his employer during the previous year 2007–08.

A rent-free furnished house in Patna (rent of unfurnished house paid by employer- Rs. 84,000, rent of furniture Rs. 18,000, free services of a gardener (salary-Rs. 4,000), free services of cook (salary-Rs. 3,600), free services of watchman (salary-Rs. 900). He owns a small house at Patna.

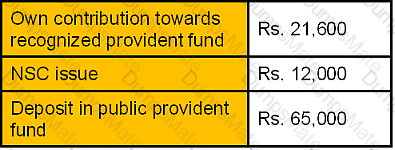

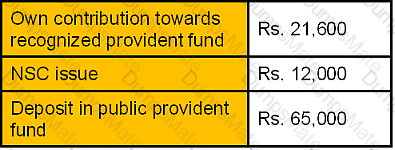

Mr. Adhikari makes the following payments and investments during the year:

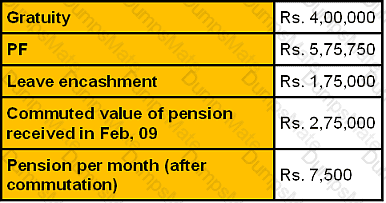

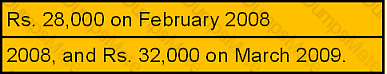

Mr. Adhikari comes to Mr. Gupta, CWM®, in September-2008 for developing a wealth plan to fulfill his financial goals. Mr. Adhikari will retire on 31st December, 2008 after completing 28 years of service. He is expecting a growth of Rs. 1,500 in his basic pay in the last year of his employment. The company is expecting a 5% growth every year in its turnover. His daughter Pallavi has completed her education and his main liability is the amount he may have to spend for her marriage. On his retirement he is expected to receive following amount:

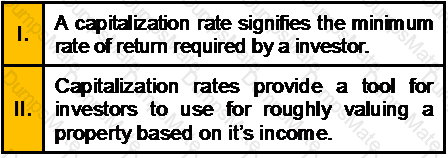

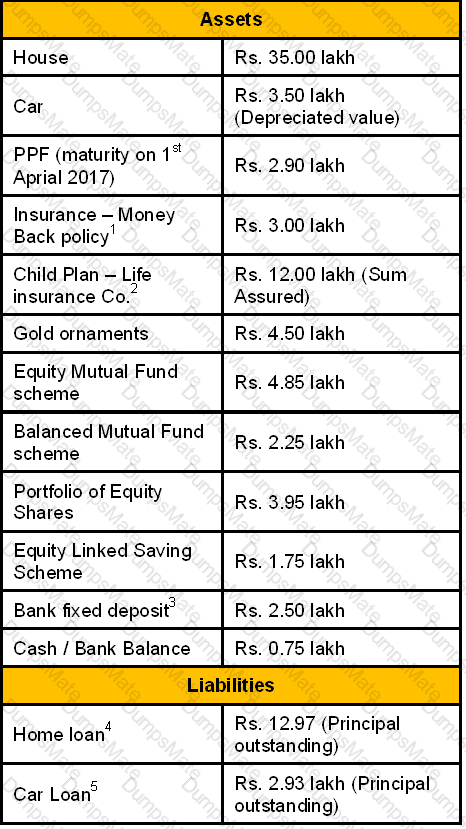

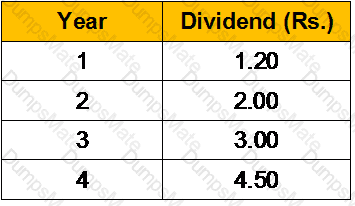

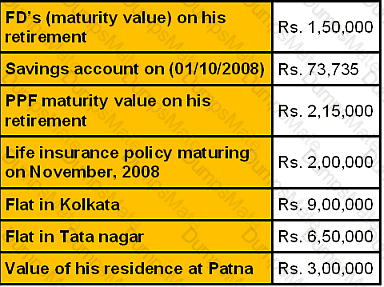

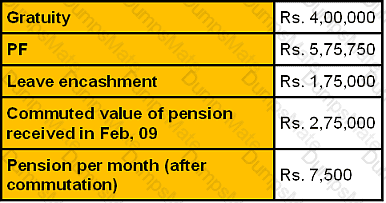

He also has also informed to the planner following his other assets and investments:

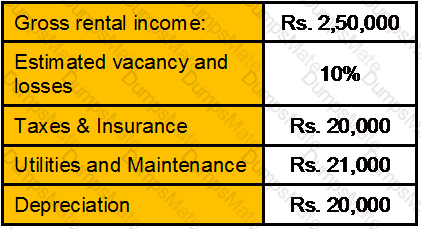

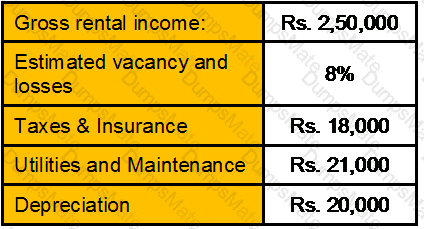

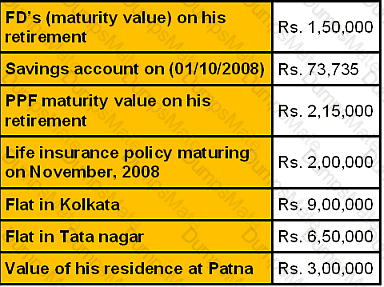

He has given his Kolkata Flat on 12,500 p.m. rent. Municipal value of the property is Rs. 1,45,000, fair rent is Rs. 1,60,000 and standard rent is 1,40,000. Municipal tax paid by him are as follows:

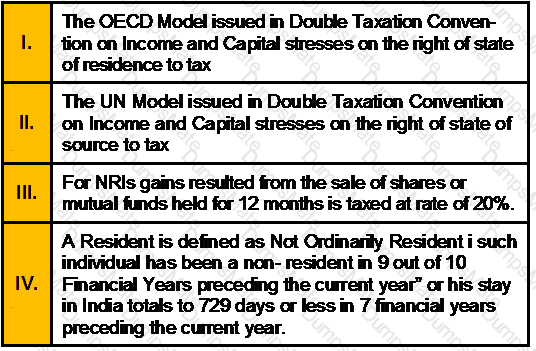

In July, 2008 rent is increased from Rs. 11,500 to Rs. 12,500 pm with effect from 01/04/2007. Due to some dispute rent was not received in 2007–08 but all arrears of rent till date are paid on July 1, 2008. Maximum eligible amount of PPF contribution deposited in March, 2008.

His actual expenses before retirement are Rs. 23,500 per month.

Main goals of Mr. Adhikari:

●To provide for his daughter’s marriage

●Ensuring that his family is protected financially in the event of any mishap

●Minimize tax burden

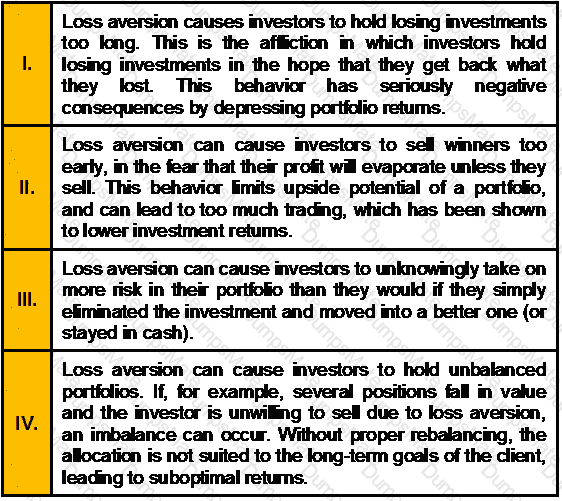

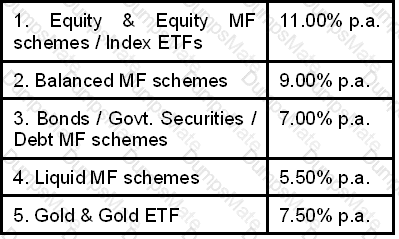

●Establish an investment portfolio that gives high returns over long term

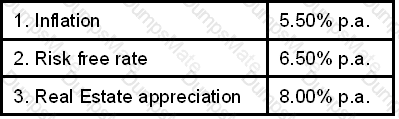

Assumptions:

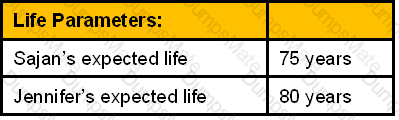

●Mr. Adhikari needs to provide for himself and his family till he is 75.

●Inflation rate after retirement to be 4%

●Monthly expenses after retirement will be 15% less than before retirement

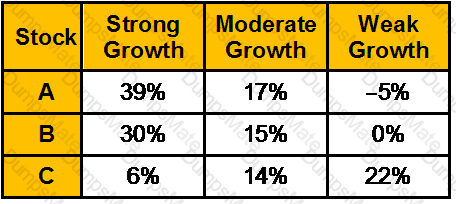

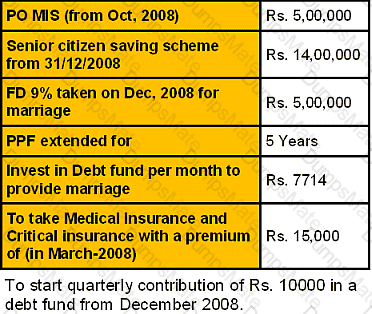

After detailed discussion, Mr. Gupta, CWM®, has suggested a revision in the portfolio as below to be implemented from October, 2008.