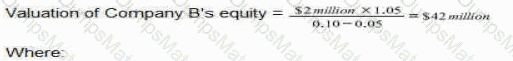

For a company valued using the free cash flow to equity with constant growth, the standard Gordon growth formula is:

Value of equity=FCF1ke−g\text{Value of equity} = \frac{\text{FCF}_1}{k_e - g}Value of equity=ke−gFCF1

Where:

FCF₁ = free cash flow in one year’s time

kek_eke = cost of equity

ggg = constant growth rate

Here:

FCF₁ = $100,000

ke=10%=0.10k_e = 10\% = 0.10ke=10%=0.10

g=5%=0.05g = 5\% = 0.05g=5%=0.05

Correct valuation:

Value=100,0000.10−0.05=100,0000.05=$2,000,000\text{Value} = \frac{100{,}000}{0.10 - 0.05} = \frac{100{,}000}{0.05} = \$2{,}000{,}000Value=0.10−0.05100,000=0.05100,000=$2,000,000

The analyst instead did:

100,000×(1+0.05)/0.10=105,000/0.10=$1,050,000100{,}000 \times (1 + 0.05) / 0.10 = 105{,}000 / 0.10 = \$1{,}050{,}000100,000×(1+0.05)/0.10=105,000/0.10=$1,050,000

So the true value is $2,000,000 and the analyst’s value is $1,050,000.

Undervaluation=2,000,000−1,050,000=$950,000\text{Undervaluation} = 2{,}000{,}000 - 1{,}050{,}000 = \$950{,}000Undervaluation=2,000,000−1,050,000=$950,000

So the company has been undervalued by $950,000 → Option A.