A company is considering investing $680,000 in a machine to manufacture a new product. A consultant has been appointed to advise on the investment and the company is committed to paying $10,000 to the consultant in year 1, even if the project does not go ahead.

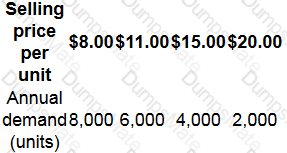

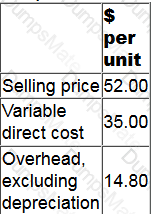

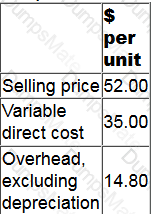

300,000 units of the new product will be produced and sold each year. Unit cost and revenue information based on this level of output is as follows.

60% of the overhead cost is variable. Of the remainder, 10% consists of allocated head office overheads.

The selling price will increase by 2% each year in line with inflation, beginning in year 2. Fixed price contracts mean that all unit costs will remain unaltered.

Taxation information:

• 100% first year allowance will be available for the purchase of the machinery.

• The taxation rate is 30% of taxable profits, payable in the year after that in which the liability arises.

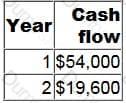

For the purpose of deciding whether to proceed with the investment, what is the relevant cash flow in year 2?